Loyalty programs have proven popular with travelers since they were first introduced by American Airlines in 1981. It would be accurate to say they’ve been a reliable, competitively advantageous source of ancillary revenue.

But have frequent-flyer programs fostered true brand loyalty — and can they overcome the pressures of a new generation of fickle flyers?

In the following blog post, we’ll look at successful elements of loyalty programs and the impact of the recent trend towards revenue-based mileage accruals.

The State of Modern Rewards Programs

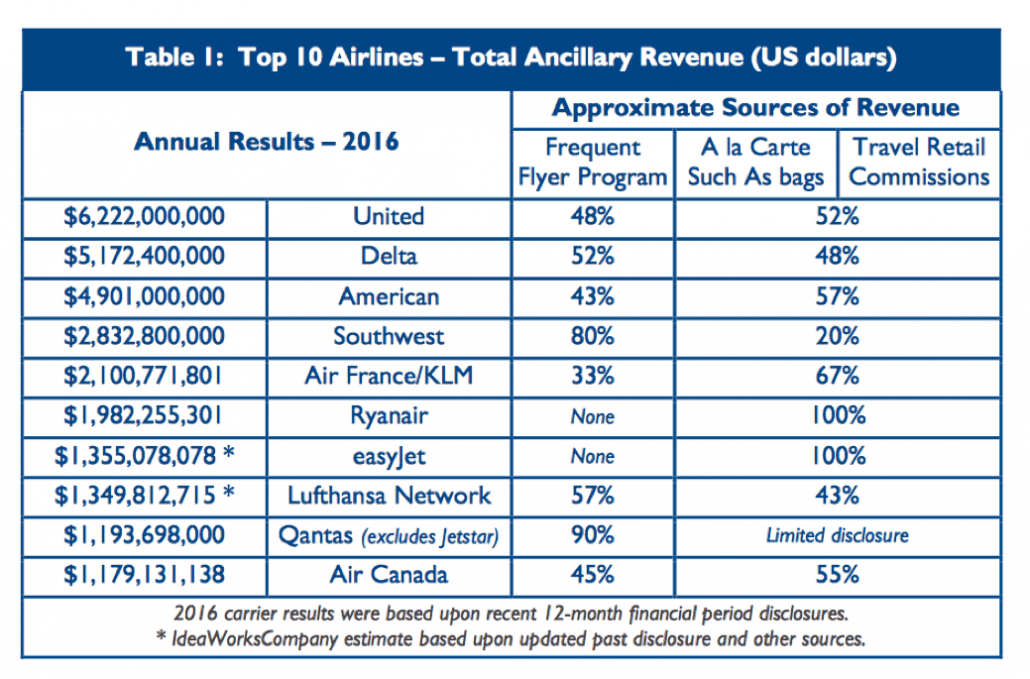

Airline consultancy IdeaWorks, working with technology firm CarTrawler, regularly publishes reports on airline ancillary revenue, including from the sales of frequent-flyer miles to third-party partners. The popularity of frequent-flyer miles is such that these are a dominant earnings category for airlines. The following table shows the significant contribution that frequent-flyer programs make to airline profitability.

However, some airlines have made changes to their programs by tying miles to fare-tier revenue more directly, and by increasing the number of miles required to reap certain rewards. As a result, some of the most popular mileage programs are now somewhat devalued.

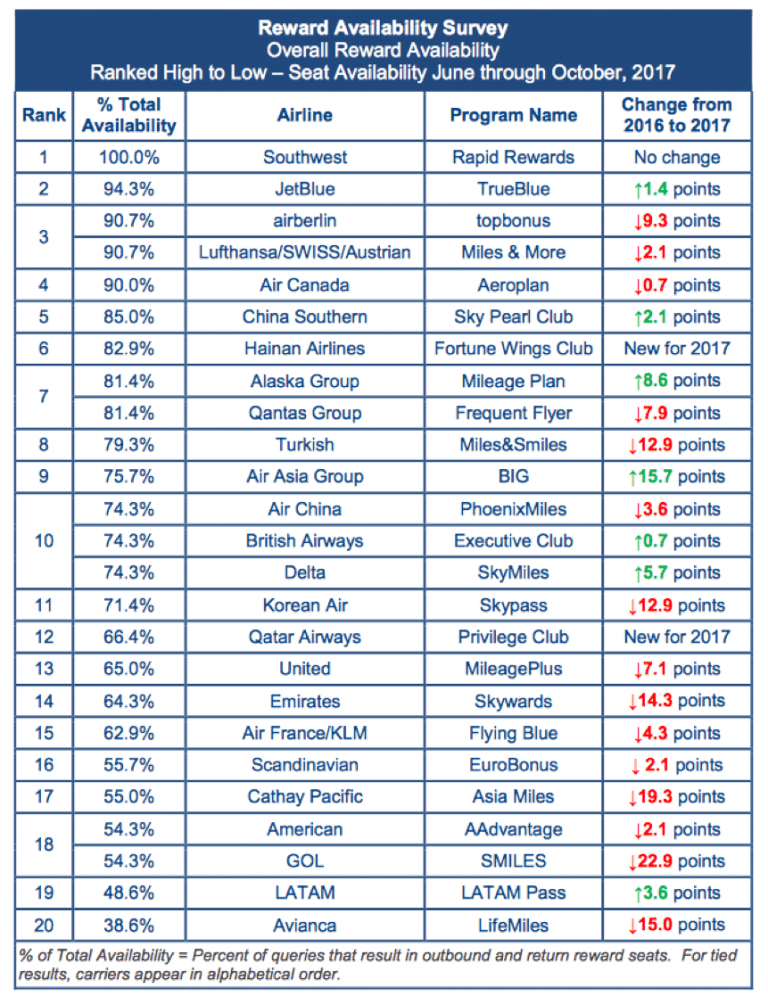

This chart by IdeaWorks and Car Trawler, released in the spring of 2017, shows the availability of reward seats for frequent-flyer account holders:

While these program changes have supported airline profitability and kept up with higher demand from revenue flyers, they have weakened the correlation between offering miles and earning customer loyalty.

In fact, while mileage programs are attractive and no airline would be advised to eliminate them, they have been in decline in terms of driving consumer choice, communicating the brand’s value and building loyal brand ambassadors.

“I don’t think program members are more likely to be brand spokespersons,” says Jay Sorensen, President of IdeaWorks. “I think the number-one, and perhaps only, motivation for someone to leap to that level of support is complete satisfaction with the product experience. If a consumer is unhappy with the product, no amount of miles or points will encourage them to be a supporter.”

Is Earn-and-Burn Dead?

Frequent-flyer program expert Gary Leff explains that mileage programs are less related to airline preference these days for two reasons:

- That most miles can be earned through activities other than flying, such as bookings with hotel partners and loyalty credit-card spending; and

- That the devaluation of programs have limited the level of inconvenience frequent flyers might endure to earn miles by flying.

“What was once a huge driver of loyalty behavior is now less so,” Leff says. “Status has been reduced substantially over the past few years, in terms of its effect, because the miles you are earning are worth less and you are earning less. The revenue-based system is cost cutting in two dimensions. It’s a less powerful value proposition.”

As a result, Leff continues, “Miles aren’t driving the decision to fly. Price, schedule and product are ahead.”

Leff divides frequent-flyer mileage activity into two distinct categories: Earning for status, and earning miles to use for free travel (AKA “earn and burn”). Of these two, status is the most appealing to frequent flyers and the most likely to build brand loyalty.

This touches on the core of value brand identity — that access to a superior product and service, as well as recognition as a valued customer, are truer loyalty drivers than points or miles.

“Miles aren't driving the decision to fly. Price, schedule and product are ahead.”

-GARY LEFF

FREQUENT-FLYER PROGRAM EXPERT

Preferred Status, Not Points

In fact, prestige can count for a lot. The Pan Am brand still endures in memory today as offering a luxurious experience, even though the cabin product offered then pales when compared to superior cabin products offered today.

For instance, Pan Am — which shuttered in 1991 — had no lie-flat seats, no in-seat theaters with access to thousands of content titles, and no Wi-Fi. But, in its time, it did offer the best products available on the market and it’s easy to imagine that if Pan Am were still flying today, it would remain on the cutting edge of the passenger experience. That is because offering the best was always a core value of the brand’s differentiation strategy.

Pan Am offered status, for sale through its Clipper Club. This exclusive club of paid members had access to superior cabins and to lounges offering critical secretarial and communications services in the era before mobile phones and laptops. These VIPs were invited to participate in exclusive events throughout the year. Pan Am executives sought their opinion in the design of new cabins. This paid program fostered repeat business because customers were already heavily invested in their relationship with the airline, and also because the airline acknowledged customers as stakeholders and ambassadors for the brand.

That level of loyalty is more than miles can earn. Consumers value what they pay for, and will pay for what they value.

Earning Loyalty Through Improved Products

As airlines invest in brand differentiation and improving cabin products, they are becoming more successful at driving consumer choice and repeat business. This brand differentiation can sometimes focus on convenient routes and schedules, better fares or better product in highly competitive markets. Leff admits that, despite mileage status, he has booked flights on airlines when he felt the route was more convenient or the cabin product superior.

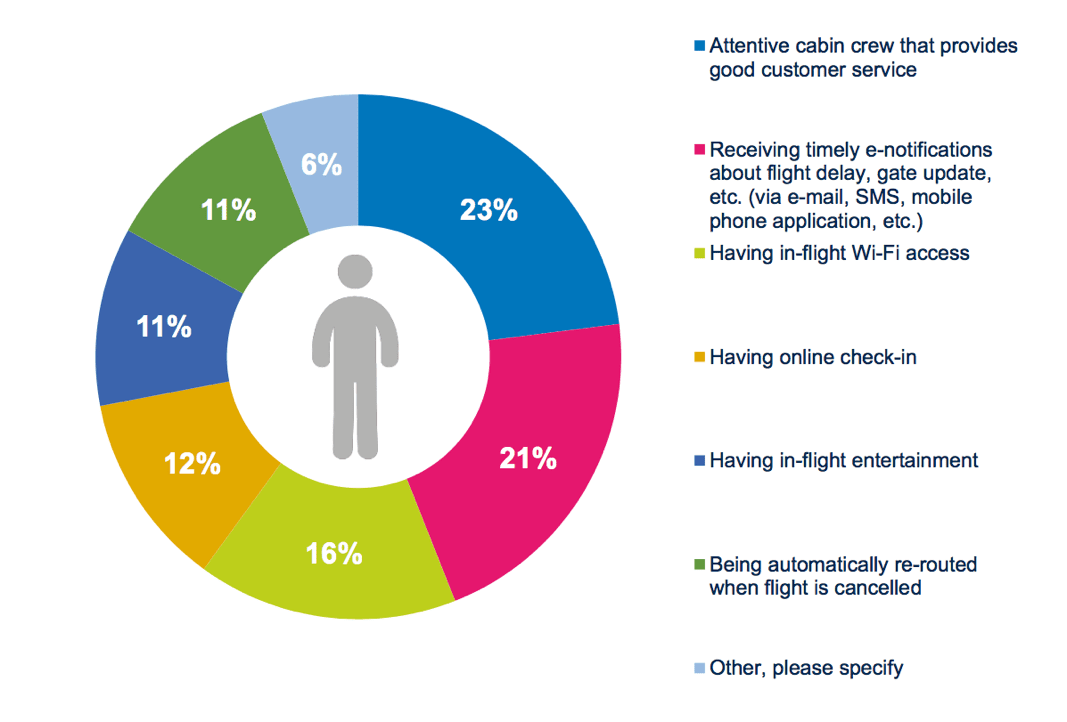

In fact, IATA’s most recent Global Passenger Survey finds that onboard comfort is the third top driver of airline loyalty, after ticket price and flight schedule, and even above other factors like punctuality and responsive customer service. Additionally, IATA reports, “Overall, inflight services and onboard comfort (cabin crew, Wi-Fi access, and IFE) significantly impact a passenger’s experience (50 percent).” Passenger perception and preference for inflight entertainment showed that 37 percent of those surveyed “appreciate having more choice options.”

That said, frequent-flyer programs do offer airlines significant value as marketing tools, Leff and Sorensen both point out. The data they help gather on consumer preference and behavior are invaluable for personalized offers that drive sales. Leff describes frequent-flyer programs as the world’s best (and only) revenue-earning marketing initiatives.

“I’ve never seen an airline drop their frequent-flyer program,” Sorensen says. “Of course, to be the ‘odd man out’ without a program would be a commercial disaster. But beyond that, these programs deliver the ability to communicate to best customers, gather data on purchase behaviors and yes, use rewards to encourage repeat purchase behavior.”

The key to earning loyalty from miles is to balance between mileage valuation and product/service competitiveness.

Airlines may still need to change the value of their miles to encourage premium bookings, but they will need to ensure that the products and services they offer customers will add value to this higher spending. Failing to make mileage programs appealing to customers may ultimately make buying miles for these popular programs unappealing to partners. Leff says this dynamic will be governed by competition in the market.

“I think if we were in a more competitive environment, an airline would take a position that they would offer a better product and I would go out of the way to fly with them,” he says. “Another airline would look to make their frequent-flyer program more generous, and that would also generate loyalty.”

Converting Gen Trippers Into Loyal Frequent Flyers

Gen Trippers will fly often, but they won’t want to fly disconnected — and earning their loyalty depends entirely on what services are available on board. For airlines, it’s not one or the other when it comes to offering inflight connectivity and live TV. Both are equally important as the news cycle speeds up and more people develop digital lifestyles.

“This again places an emphasis on giving the Gen Tripper the power, literally and figuratively, and the access to be able to work, search, engage, upload, download and watch-relax regardless of cabin, length of flight or journey-point in their travel experience,” Nurko says.

With thousands of Gen Trippers young and old hidden among the passengers at the back of the plane, airlines cannot afford to ignore their needs. As this group grows and prospers, the likelihood that they will pay premium tickets and buy ancillary services and products increases. Earning these customers’ business and loyalty through first-class service — even when they’re in the 29th row — is essential in today’s travel economy.